INDUSTRY

How to Get a Personal Loan in the UK: A Simple 4-Step Guide to Get You Approved

How to Get a Personal Loan in the UK: A Simple 4-Step Guide to Get You Approved

Before getting your personal UK loan, you must read this! There are other options instead of getting into debt, that could spiral out of control. The average person in the UK owes £8,000. Getting into debt can lead to a downward spiral of more debt, and you may have options you didn't think of. Have you thought about these ways to avoid having to get a loan? Saving money is as good as making it!

Can you sell things you aren't using anymore or push back the purchase?

For example, swapping it for something else, buying it second-hand or getting it for free from a free recycling website.

If you need a loan for essentials like food and rent, you don't need a loan, you need help.

Can you wait until you have saved the money you need?

If you want a loan for a holiday or some jewellery, for example, you probably shouldn't be taking out a loan. Avoiding loans for consumer goods, cars, and non-essential items will help you avoid the emotional stress of owing money.

Start putting money aside now and pay for it in cash in a few months. This way you will never overextend yourself, and you are more likely to get the loan the first time around avoiding multiple hits on your credit score which can hurt you later.

If you are paying a company or someone back, can you renegotiate the payment over a longer time?

As bad as you may feel owing a friend, family member or company, the terms are probably better and less onerous than taking out a separate loan from a bank to pay that back. Most people and companies are reasonable when they believe you are sincere in your intentions to repay the loan. Ask your boss for an advance if need be. When you have less money in your next pay check, you will be forced to make do and stop kicking the 'debt can' down the road, inflicting further interest and fees from a proper loan.

Staying self-sufficient financially will save you huge emotional stress that taking out loans can cause long term.

Some situations call for a loan

Moving ahead with a loan application

Of course, there are some situations that require a main street loan and here is how to get approved and manage the loan.

How do UK personal loans work?

Personal loans are loans given to borrowers to pay off other types of debt. For instance, if you are having trouble paying back your credit card, you might have a personal loan to pay off that debt. You can get personal loans from banks and other lenders. If you are a borrower that is just starting to make payments on a credit card, or have several years of a balance, you will want to find the best personal loan for you. In order to choose the best personal loan, you must make sure you can afford the loan.

Personal loan payments can be very high if you have a large amount of debt. Most personal loan rates are fixed. The rate of interest will stay the same regardless of the amount of money you borrow. Variable interest rates can work if you have a small balance.

Getting Approved for a Loan

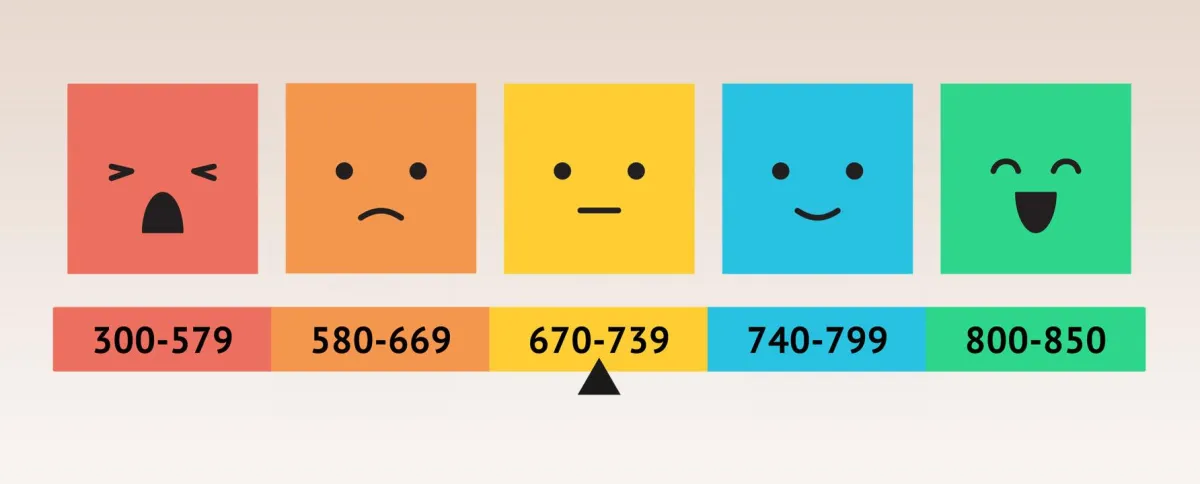

If you are getting a personal loan from a financial institution, there are rules that need to be followed. It all starts with your credit score...

1. Fill out the pre-qualification form

Getting pre-qualified for a personal loan gives you a preliminary credit score and takes up a lot of time. It isn't an indication of the loan you might receive, but it is an indication of what a lender thinks or believes about your creditworthiness. Lenders will verify your information before final approval.

Many lenders let you pre-qualify on their website by filling out an online form, which can include:

Personal information (name, date of birth and Social Security number)

Contact details (address and phone number)

Employment details (including your annual income)

Financial information(savings, retirement or investment accounts)

Loan request amount, loan purpose and repayment term

When choosing a personal loan, we recommend comparing multiple offers. A lender must consider a number of factors when determining your interest rate and loan amount. Interest rates might change based on your credit score, employment history, debt-to-income ratio, and other aspects of your financial picture.

2. Soft credit check

Pre-qualifying for a personal loan shouldn't negatively affect your credit score.

When you fill out the pre-qualification form, lenders will only do a soft credit check that won't show up on your credit report. Those who pre-qualify with multiple lenders can get a better rate and find the best loan for their specific needs.

If you provide a complete and accurate history of your financial information, the debt lender will then verify your application with hard credit check report. This will be used in conjunction with other accounts to determine whether you qualify for credit or if the lender will reject or cancel your loan application.

3. Approval notification

If you want to pre-qualify for the best personal loans, you need to have good credit. Having a good credit score is the best way to increase your likelihood of pre-qualifying for the best personal loans. Pay your bills on time, keep your balances low and aim to pay your credit card balances in full each month to keep your debt low.

A good credit score is important if you’re applying for a mortgage, looking for a job, or applying for a visa. The higher your credit score, the better off you will be.

How to get a loan with bad credit

If you have bad credit and are concerned about which loan to choose, borrowing from credit unions may be an option. Credit unions offer fixed-rate loans with lower interest rates than most banks. They can also evaluate applicants based on factors such as their income or the value of their assets.

There are plenty of personal loan lenders that are willing to lend to people with bad credit. These lenders take your past and present employment history into account in order to decide if you are a good candidate for the loan. They use this information to assess the risk of defaulting on the loan.

If you need a loan, you could consider applying for a secured personal loan. These loans require that you pledge your car or another type of collateral when applying for the loan. It is usually easier to get approved for a secured loan, but you may lose the collateral if you fail to make payments.

Credit score boosting tips:

You can manage your credit score by paying your bills on time, always keeping an open account, and being on time with your payments for your loan. You should keep your credit balance at around 40% of the credit limit. All of these things are what the UK financial institution will consider as your credit score. Most lenders will also take your overall income into consideration. Paying your rent on time is important to reduce your debt. Also, if you have any debts with other companies, they will be taken into consideration as well.

One way to track your progress in paying back debt is to “snowball” it. By paying more than the minimum balance due each month, the amount of interest you pay will increase. This is a great way to stay focused on your debt and stay ahead of the game.

In short, paying off debt is about prioritising which debts to pay off first. If you're using snowball (or any plan) to make your payments fit into a specific budget, you could end up spending so much money on the smallest balances that you'd never get to the larger balances. This is why it's important to create a plan that prioritises highest-interest debts first.

Credit score bonus reading:

If you have tried everything else, here are even more ways to improve your credit score. As you can perhaps tell, UK loan approval starts and ends with your credit score.

Click here to get your credit score and tips on how to improve it.

The loaner will calculate what you can borrow

4. Formal application

Once you submit your pre-qualification form, you will be prompted to select a loan amount, rate and repayment term. You can then proceed with applying for your personal loan.

This part of the application requires you to upload information about your bank account, recent tax returns, and other financial documents. This helps your lender verify that the information you provided is accurate. The lender will also perform a hard credit check on you.

If you're approved for a loan, you can get your cash as soon as the next business day. Most lenders offer funding within one week.

Non-Approval

If you are denied credit by a credit reporting agency, you will receive a letter from the agency that explains the reasons for the denial. The letter will also include information about the credit agency that provided the report, your current score and factors contributing to it, and how you can get a free copy of your report.

This information can help you improve your credit score and make it more likely that you'll be approved for a loan in the future.

There is no doubt that personal loans and credit cards are convenient. However, you need to carefully monitor how much money you are spending, and how much you are using. Try to save money, so you can borrow it if you need it. Bank charges can quickly erode savings. Be aware of the fine print on your credit card, and read it before you sign. Only use a credit card with 0% annual percentage rate (APR) and do some basic comparison before you start charging!

5 Saving Hacks

1. No spend week

Have a ‘no spend’ weekend every monthEvery month, take the whole weekend off from spending money. Don’t go shopping, don’t go out to eat, don’t go to the movies, and don’t buy any new clothes. Try to do things for free or for cheap so you learn to appreciate the things you already have.

2. Transfer something into your savings account monthly… even if it’s just pennies

I do a daily bank transfer into my savings account, even if it’s just pennies. It’s a great way to make sure you have money set aside for a rainy day, for a holiday, or for the future.

3. Reconfigure your monthly bills

If you’re on a variable rate tariff with your energy supplier, you can sign up for a fixed rate tariff with the same supplier and lock in a lower rate. This works best if you plan to stay in your home for a while.

4. Circumvent your splurges

You should always try to save the amount you want to splurge on a purchase. For example, if you want to buy a £150 pair of designer shoes, try to save £150 first. This way, you won't feel the pain of parting with your cash.

5. Pricey debts first!

Pay off your credit card debts as soon as you can. This is the single most important thing you can do to protect your future wealth. Pay off your credit card debts as soon as you can. This is the single most important thing you can do to protect your future wealth.

Final thought

Payday loans are designed to trap you in a cycle of debt. When an emergency hits and you have poor credit and no savings, it may seem like you have no other choice. But choosing a payday loan negatively affects your credit, any savings you could have had, and may even cause you to land you in court.

Either you have a decent credit score and you can get much better terms or you need to fix your credit score and we'll show you how.There are always better options for a personal loan than payday loans, so just don't do it.

Conclusion

If you are not approved, think of it as a challenge and perhaps a blessing in disguise.

You might want to rethink whether you are in a position to get a loan in the first place. The system was conceived not only to protect loaners but also those wishing to get the loan. Saving money is like giving yourself a loan in the future, something to remember when you are about to spend when you could probably avoid it without much discomfort.

If you absolutely need the cash, consider other ways to get help from places that are less expensive and less harmful to your financial health. If you really need money, request a loan from your parents, extended family member or friend.

Related Posts

How to Get a Personal Loan in the UK: A Simple 4-Step Guide to Get You Approved

How to Get a Personal Loan in the UK: A Simple 4-Step Guide to Get You Approved

Before getting your personal UK loan, you must read this! There are other options instead of getting into debt, that could spiral out of control. The average person in the UK owes £8,000. Getting into debt can lead to a downward spiral of more debt, and you may have options you didn't think of. Have you thought about these ways to avoid having to get a loan? Saving money is as good as making it!

Can you sell things you aren't using anymore or push back the purchase?

For example, swapping it for something else, buying it second-hand or getting it for free from a free recycling website.

If you need a loan for essentials like food and rent, you don't need a loan, you need help.

Can you wait until you have saved the money you need?

If you want a loan for a holiday or some jewellery, for example, you probably shouldn't be taking out a loan. Avoiding loans for consumer goods, cars, and non-essential items will help you avoid the emotional stress of owing money.

Start putting money aside now and pay for it in cash in a few months. This way you will never overextend yourself, and you are more likely to get the loan the first time around avoiding multiple hits on your credit score which can hurt you later.

If you are paying a company or someone back, can you renegotiate the payment over a longer time?

As bad as you may feel owing a friend, family member or company, the terms are probably better and less onerous than taking out a separate loan from a bank to pay that back. Most people and companies are reasonable when they believe you are sincere in your intentions to repay the loan. Ask your boss for an advance if need be. When you have less money in your next pay check, you will be forced to make do and stop kicking the 'debt can' down the road, inflicting further interest and fees from a proper loan.

Staying self-sufficient financially will save you huge emotional stress that taking out loans can cause long term.

Some situations call for a loan

Moving ahead with a loan application

Of course, there are some situations that require a main street loan and here is how to get approved and manage the loan.

How do UK personal loans work?

Personal loans are loans given to borrowers to pay off other types of debt. For instance, if you are having trouble paying back your credit card, you might have a personal loan to pay off that debt. You can get personal loans from banks and other lenders. If you are a borrower that is just starting to make payments on a credit card, or have several years of a balance, you will want to find the best personal loan for you. In order to choose the best personal loan, you must make sure you can afford the loan.

Personal loan payments can be very high if you have a large amount of debt. Most personal loan rates are fixed. The rate of interest will stay the same regardless of the amount of money you borrow. Variable interest rates can work if you have a small balance.

Getting Approved for a Loan

If you are getting a personal loan from a financial institution, there are rules that need to be followed. It all starts with your credit score...

1. Fill out the pre-qualification form

Getting pre-qualified for a personal loan gives you a preliminary credit score and takes up a lot of time. It isn't an indication of the loan you might receive, but it is an indication of what a lender thinks or believes about your creditworthiness. Lenders will verify your information before final approval.

Many lenders let you pre-qualify on their website by filling out an online form, which can include:

Personal information (name, date of birth and Social Security number)

Contact details (address and phone number)

Employment details (including your annual income)

Financial information(savings, retirement or investment accounts)

Loan request amount, loan purpose and repayment term

When choosing a personal loan, we recommend comparing multiple offers. A lender must consider a number of factors when determining your interest rate and loan amount. Interest rates might change based on your credit score, employment history, debt-to-income ratio, and other aspects of your financial picture.

2. Soft credit check

Pre-qualifying for a personal loan shouldn't negatively affect your credit score.

When you fill out the pre-qualification form, lenders will only do a soft credit check that won't show up on your credit report. Those who pre-qualify with multiple lenders can get a better rate and find the best loan for their specific needs.

If you provide a complete and accurate history of your financial information, the debt lender will then verify your application with hard credit check report. This will be used in conjunction with other accounts to determine whether you qualify for credit or if the lender will reject or cancel your loan application.

3. Approval notification

If you want to pre-qualify for the best personal loans, you need to have good credit. Having a good credit score is the best way to increase your likelihood of pre-qualifying for the best personal loans. Pay your bills on time, keep your balances low and aim to pay your credit card balances in full each month to keep your debt low.

A good credit score is important if you’re applying for a mortgage, looking for a job, or applying for a visa. The higher your credit score, the better off you will be.

How to get a loan with bad credit

If you have bad credit and are concerned about which loan to choose, borrowing from credit unions may be an option. Credit unions offer fixed-rate loans with lower interest rates than most banks. They can also evaluate applicants based on factors such as their income or the value of their assets.

There are plenty of personal loan lenders that are willing to lend to people with bad credit. These lenders take your past and present employment history into account in order to decide if you are a good candidate for the loan. They use this information to assess the risk of defaulting on the loan.

If you need a loan, you could consider applying for a secured personal loan. These loans require that you pledge your car or another type of collateral when applying for the loan. It is usually easier to get approved for a secured loan, but you may lose the collateral if you fail to make payments.

Credit score boosting tips:

You can manage your credit score by paying your bills on time, always keeping an open account, and being on time with your payments for your loan. You should keep your credit balance at around 40% of the credit limit. All of these things are what the UK financial institution will consider as your credit score. Most lenders will also take your overall income into consideration. Paying your rent on time is important to reduce your debt. Also, if you have any debts with other companies, they will be taken into consideration as well.

One way to track your progress in paying back debt is to “snowball” it. By paying more than the minimum balance due each month, the amount of interest you pay will increase. This is a great way to stay focused on your debt and stay ahead of the game.

In short, paying off debt is about prioritising which debts to pay off first. If you're using snowball (or any plan) to make your payments fit into a specific budget, you could end up spending so much money on the smallest balances that you'd never get to the larger balances. This is why it's important to create a plan that prioritises highest-interest debts first.

Credit score bonus reading:

If you have tried everything else, here are even more ways to improve your credit score. As you can perhaps tell, UK loan approval starts and ends with your credit score.

Click here to get your credit score and tips on how to improve it.

The loaner will calculate what you can borrow

4. Formal application

Once you submit your pre-qualification form, you will be prompted to select a loan amount, rate and repayment term. You can then proceed with applying for your personal loan.

This part of the application requires you to upload information about your bank account, recent tax returns, and other financial documents. This helps your lender verify that the information you provided is accurate. The lender will also perform a hard credit check on you.

If you're approved for a loan, you can get your cash as soon as the next business day. Most lenders offer funding within one week.

Non-Approval

If you are denied credit by a credit reporting agency, you will receive a letter from the agency that explains the reasons for the denial. The letter will also include information about the credit agency that provided the report, your current score and factors contributing to it, and how you can get a free copy of your report.

This information can help you improve your credit score and make it more likely that you'll be approved for a loan in the future.

There is no doubt that personal loans and credit cards are convenient. However, you need to carefully monitor how much money you are spending, and how much you are using. Try to save money, so you can borrow it if you need it. Bank charges can quickly erode savings. Be aware of the fine print on your credit card, and read it before you sign. Only use a credit card with 0% annual percentage rate (APR) and do some basic comparison before you start charging!

5 Saving Hacks

1. No spend week

Have a ‘no spend’ weekend every monthEvery month, take the whole weekend off from spending money. Don’t go shopping, don’t go out to eat, don’t go to the movies, and don’t buy any new clothes. Try to do things for free or for cheap so you learn to appreciate the things you already have.

2. Transfer something into your savings account monthly… even if it’s just pennies

I do a daily bank transfer into my savings account, even if it’s just pennies. It’s a great way to make sure you have money set aside for a rainy day, for a holiday, or for the future.

3. Reconfigure your monthly bills

If you’re on a variable rate tariff with your energy supplier, you can sign up for a fixed rate tariff with the same supplier and lock in a lower rate. This works best if you plan to stay in your home for a while.

4. Circumvent your splurges

You should always try to save the amount you want to splurge on a purchase. For example, if you want to buy a £150 pair of designer shoes, try to save £150 first. This way, you won't feel the pain of parting with your cash.

5. Pricey debts first!

Pay off your credit card debts as soon as you can. This is the single most important thing you can do to protect your future wealth. Pay off your credit card debts as soon as you can. This is the single most important thing you can do to protect your future wealth.

Final thought

Payday loans are designed to trap you in a cycle of debt. When an emergency hits and you have poor credit and no savings, it may seem like you have no other choice. But choosing a payday loan negatively affects your credit, any savings you could have had, and may even cause you to land you in court.

Either you have a decent credit score and you can get much better terms or you need to fix your credit score and we'll show you how.There are always better options for a personal loan than payday loans, so just don't do it.

Conclusion

If you are not approved, think of it as a challenge and perhaps a blessing in disguise.

You might want to rethink whether you are in a position to get a loan in the first place. The system was conceived not only to protect loaners but also those wishing to get the loan. Saving money is like giving yourself a loan in the future, something to remember when you are about to spend when you could probably avoid it without much discomfort.

If you absolutely need the cash, consider other ways to get help from places that are less expensive and less harmful to your financial health. If you really need money, request a loan from your parents, extended family member or friend.

©2023 Wishborn Tous droits réservés.

Wishborn est une association française de 1901 ARN : W751260870

11 rue des Petites Ecuries, Paris, France

Wishborn is a personal development educational non-profit that provides free and development tools and training for self-improvement. Our mission is to inspire motivated individuals to flip perspectives in their life and business in order to increase health, wealth, and wisdom.

In partnership with Holly Hove.

Google Ads Disclaimer: This disclaimer states there is no guarantee of specific results and each person results may vary. The information on this site is not intended or implied to be a substitute for professional advice or consultation on the subject. All content, including text, graphics, images and information, contained on or available through this web site is for general information purposes only. Wishborn makes no representation and assumes no responsibility for the accuracy of information contained on or available through this web site, and such information is subject to change without notice. You are encouraged to confirm any information obtained from or through this web site with other sources. Wishborn does not recommend, endorse or make any representation about the efficacy, appropriateness or suitability of any information including sponsors’ information that may be contained on or available through this web site.

WISHBORN IS NOT RESPONSIBLE NOR LIABLE FOR ANY ADVICE OR ANY OTHER INFORMATION, SERVICES OR PRODUCTS THAT YOU OBTAIN THROUGH THIS WEB SITE.